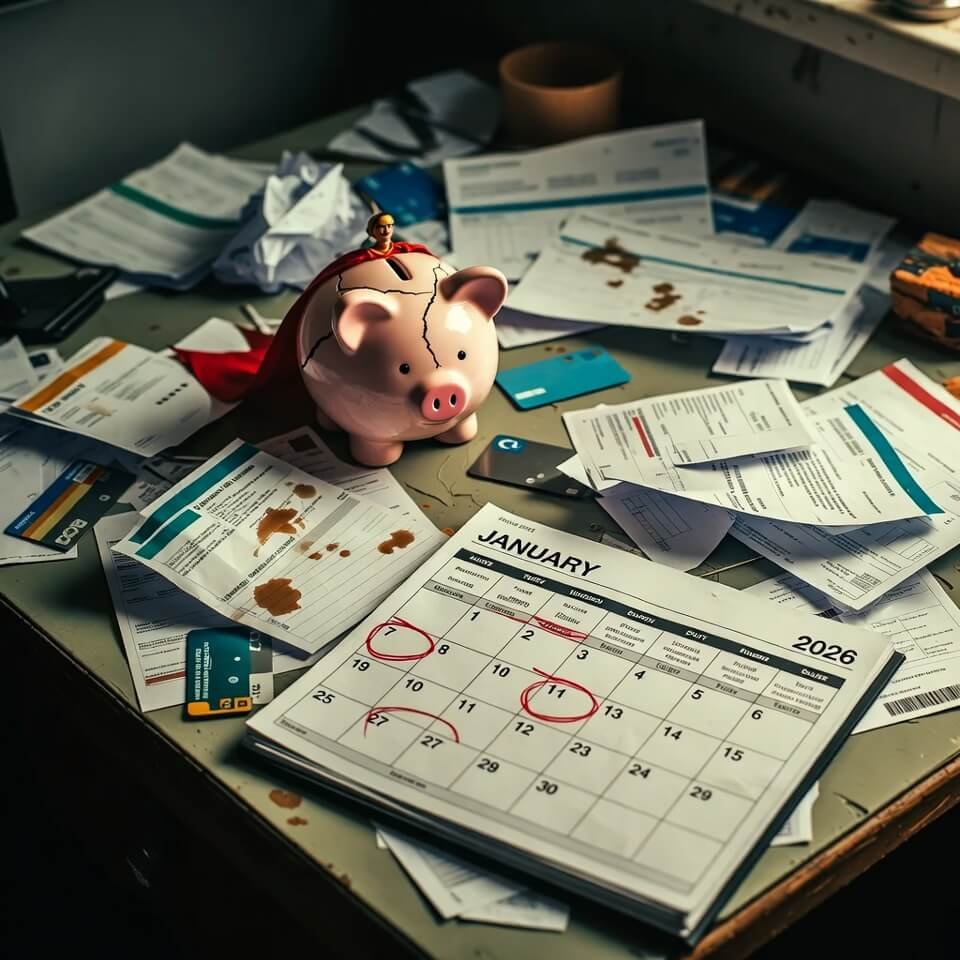

Look, I’m sitting here in my tiny apartment in [somewhere in the US – let’s just say the Midwest because the rent is still kinda sane], it’s January 2026, there’s half a cold pizza box on the coffee table, and I’m staring at my latest credit card statement like it personally insulted my mom.

Best personal loans for debt consolidation 2025? Yeah, I’ve been Googling that phrase so much lately that Google probably thinks I’m obsessed. Spoiler: I kinda am.

About 18 months ago I hit that terrifying moment where I added up all my credit card balances and realized I was paying like $680 a month just in interest. Six. Hundred. Eighty. Dollars. Every single month. Gone. Poof. I felt physically sick.

So I started seriously shopping for top debt consolidation loans because something had to give.

Here are the ones that actually made sense for someone like me (mid-30s, decent but not amazing credit, drowning in high-interest revolving debt).

1. LightStream – Still the Gold Standard (If Your Credit Is Pretty Good)

LightStream (part of Truist Bank) keeps coming up as one of the best personal loans for debt consolidation 2025 for people who have good-to-excellent credit.

- No origination fees

- No prepayment penalties

- Rates currently starting around 6.99% APR (with AutoPay discount)

- Loan amounts up to $100,000

I didn’t qualify because my score was sitting around 680 after a couple late payments (don’t judge me, 2023 was rough), but my buddy Mike did and he basically called it “free money compared to 24% credit cards.”

→ Check current rates directly: LightStream Personal Loans

2. SoFi – The One I Actually Used (and Still Love/Hate)

SoFi ended up being my pick.

They gave me $28,000 at 11.49% APR over 5 years. Yeah, not as sexy as LightStream’s rates, but:

- No fees at all

- Unemployment protection (if you lose your job they’ll pause payments)

- Huge community of people who’ve done the same thing

I’ll be honest: the first couple months after consolidating felt amazing. Like I could breathe again. Then the reality of a $650 monthly payment hit and I had to stop buying $7 oat milk lattes every day. Character-building, right?

→ See SoFi’s current offers: SoFi Personal Loans

3. Upgrade – Surprisingly Good for “Meh” Credit

If your credit is more like mine was (fair to good, 650–720 range), Upgrade is honestly one of the top debt consolidation loans 2025 for real people.

- They approve people with scores as low as ~600

- Joint applications allowed (huge if you have a partner with better credit)

- You can get the money in as little as 1 business day

Downside? They do charge origination fees (up to 9.99%), so read the fine print.

4. Upstart – The AI Weird One That Actually Worked for Me

Upstart uses your education and job history in addition to credit score. They approved me when a couple traditional banks laughed.

- Rates from ~7% to ~35% (yeah… wide range)

- Soft credit pull to pre-qualify

I almost went with them but SoFi edged them out on customer service reviews.

Quick Reality Check From Someone Who’s Been There

Consolidating my debt was one of the smartest financial moves I’ve ever made… but it’s not magic.

I still had to:

- Cut up (most of) my credit cards

- Stop treating DoorDash like a food group

- Actually stick to a stupid budget

If you’re thinking about the best personal loans for debt consolidation 2025, ask yourself:

- Can I afford the new monthly payment? (Use a loan calculator!)

- Am I ready to stop adding new debt?

- Have I checked my credit reports for errors? (I found a $1,200 medical bill that wasn’t even mine—huge win)

Final Thoughts (From a Recovering Debt Disaster)

If I could go back and tell 2024-me one thing about hunting for the best personal loans for debt consolidation 2025, it would be this:

Stop waiting for your credit to be “perfect.” It’s never going to be perfect. Just start the pre-qualification process with 3–4 lenders. It’s free, it’s fast, and it doesn’t hurt your score much.

And if you’re feeling overwhelmed, that’s normal. I still sometimes wake up at 3 a.m. convinced I’m going to screw this up again. But I’m making progress—one painfully responsible payment at a time.

You got this.

Seriously.

Now excuse me while I go cry happy tears over my shrinking credit card balances.

What about you? Have you consolidated debt before? Which lender did you end up going with? Drop your story in the comments—I’m nosy and also want to know I’m not alone in this mess. 😅