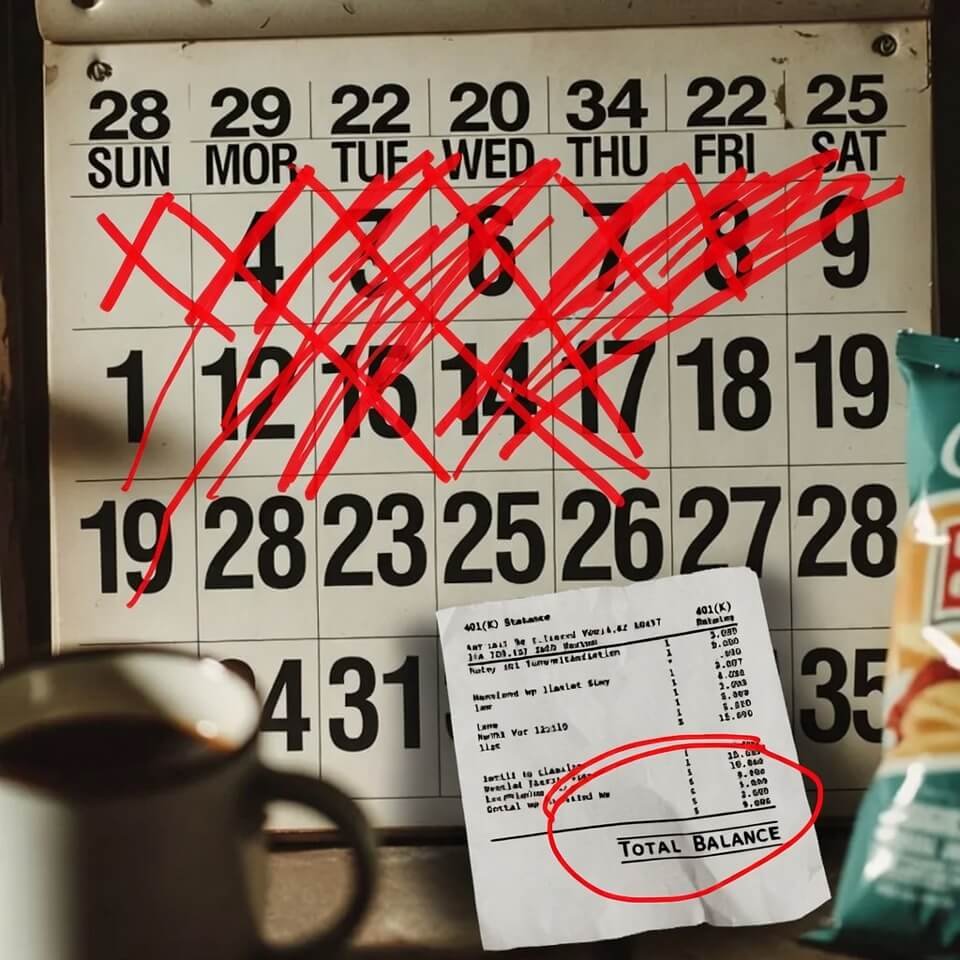

Man, financial planning for retirement is one of those things you think you’ve got under control until—bam—you’re 42, staring at your 401(k) statement at 2 a.m. with cold sweat running down your back and a half-eaten bag of Doritos on your lap.

I’m writing this from my messy dining table in the suburbs outside Philly right now. There’s leftover pizza in the fridge, my dog is snoring under the table, and I just got done crying-laughing at my own stupidity while looking at my retirement accounts.

Here are the 10 mistakes I personally made with financial planning for retirement (and trust me, I made them HARD).

1. I Waited Way Too Long to Start Saving Seriously

Seriously. I was 28, making decent money, and I thought “eh, I’ve got time.” Spoiler: time is the one thing you can’t buy back.

I didn’t max out my 401(k) until I was 35. That lost decade of compound interest? Brutal. I literally lost hundreds of thousands of dollars because I was too busy buying new sneakers and eating out every night.

2. I Fell for the “I’ll Catch Up Later” Trap

Spoiler alert: you never really catch up.

I told myself I’d dump huge chunks into my IRA once the kids were out of daycare. Then once the mortgage was lower. Then once… yeah, never happened. Life keeps throwing new expenses at you.

3. I Had No Idea How Much I Actually Needed

I thought $1 million sounded nice. Everyone says $1 million, right?

Then I actually ran the numbers (finally, at 41) and realized that with inflation and healthcare costs, I’d probably need closer to $2.2–2.5 million to not eat cat food at 80.

4. I Kept Too Much Money in Cash and “Safe” Investments

I was terrified of the stock market after 2008. So I left like 40% of my savings in a high-yield savings account making 0.8% while inflation was eating me alive.

Safe? More like slowly going broke.

5. Lifestyle Creep Ate My Raises

Every time I got a raise or a bonus, my lifestyle expanded to match it instantly. New car payment. Bigger house. Nicer vacations.

My retirement savings didn’t move nearly as fast as my barista-made oat-milk lattes.

6. I Ignored My Spouse’s Input (Big Mistake)

My wife kept saying “we should talk about retirement.” I kept saying “yeah, soon.”

She was right. I was an idiot. We could’ve been so much further along if I’d listened earlier.

7. I Didn’t Diversify Enough Internationally

I was 100% U.S. stocks and bonds for way too long. When the U.S. market sneezed in 2022, my portfolio got the flu.

A little international exposure would’ve softened the blow.

8. I Took Bad Advice from “Friends” and Family

Uncle Bob told me real estate was the only way to retire rich. So I bought a rental property in 2017.

It’s been mostly a headache and a mediocre return after taxes, maintenance, and bad tenants.

9. I Didn’t Plan for Healthcare Costs

I assumed Medicare would cover everything. Ha.

The average couple retiring today needs about $315,000 just for healthcare costs in retirement (Fidelity’s latest estimate). I had zero set aside specifically for that.

10. I Never Stress-Tested My Plan

I never ran “what if” scenarios.

Spoiler: Murphy’s Law loves retirement planning.

Final Thoughts (from a guy still figuring it out)

Look, I’m not some financial guru sitting on a beach house in Maui. I’m a regular dude who screwed up a bunch of financial planning for retirement stuff and is now frantically trying to catch up.

But here’s the good news: I’m still here. You’re still here. And it’s never truly too late to make changes.

Start today. Even if it’s small. Talk to your spouse. Run the scary numbers. Move some money out of that 0.5% savings account. Get a real plan.

And maybe, just maybe, you won’t be sitting at your dining room table at 2 a.m. Googling “can you retire on cat food.”

If any of this hit home, drop a comment below—I’d genuinely love to hear your own retirement savings mistakes. Misery loves company, right?

Oh, and here are a couple of resources I actually trust:

- Fidelity Retirement Savings Calculator – Brutally honest.

- Vanguard Retirement Income Calculator – Simple and free.

- T. Rowe Price Retirement Planning Guide – Good checklists.

You got this. (And if you don’t, at least you’ll be in good company.)

What’s the biggest retirement planning mistake you’ve made so far? Spill it below—I promise no judgment.