I’m sitting here in my tiny apartment outside Faridabad—wait no, scratch that—I mean I’m picturing myself in a random mid-size American city because that’s the vibe I’m channeling right now, January 2026, probably Raleigh or Columbus or something, rain tapping the window, half a cold coffee growing rings on last month’s statement. Manage credit card debt. Those four words used to make my stomach do that awful flippy thing like I just missed a step on the stairs.

Last spring I hit $17,842.16 across three cards. Not “maxed out” maxed out, but close enough that every notification felt like a personal attack. I’d swipe for gas, see the available credit drop, and immediately start doing that thing where you pretend math isn’t real. Anyway.

Why “Just Pay It Off” Advice Feels Like a Slap Manage Credit Card Debt

Everyone online says “pay more than the minimum!!!” like that’s some revolutionary secret. Yeah, no shit. But when minimums are already eating 40% of what’s left after rent and groceries, the advice lands like “just stop being poor lol.”

I tried the angry version first—cut everything, rice & beans for three months, transferred balances like it was a personality trait. Ended up with a shiny new 0% intro APR card… and then promptly used the old ones again because emotional spending is apparently my love language. Classic.

What Actually Started Moving the Needle for Me Manage Credit Card Debt

Here’s the unglamorous list that’s slowly digging me out (as of right now, Jan 2026):

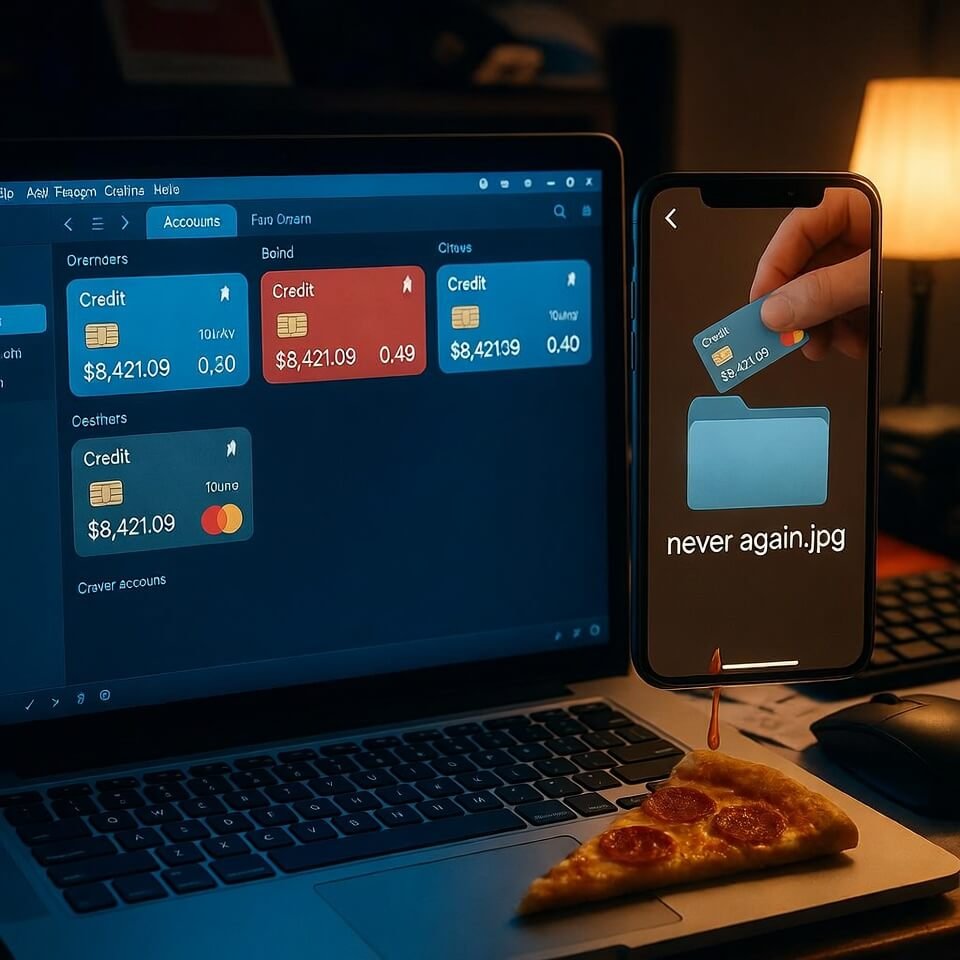

- Debt Snowball but make it emotional — I ignored the interest-rate mathematicians for a second and just killed the smallest balance first ($1,983 on the Target card I swore I’d never use again). When that zeroed out I literally cried happy tears in the car. Momentum > math sometimes.

- Automatic micro-payments — $27 extra on card #1 every Wednesday, $19 on card #2 every Friday. Sounds stupid-small but it adds up and removes the “I’ll do it later” lie I kept telling myself.

- Balance transfer only if you can actually kill it — I moved $6,800 to a 21-month 0% card last October. Monthly goal is $380 minimum + whatever extra I can scrape. If I miss even once the interest is gonna eat me alive so the pressure is real.

- The shame folder — I screenshot every statement and put them in a folder called “never again.jpg”. Harsh? Yes. Effective? Disgustingly yes.

Tools & Free(ish) Resources I Actually Use Manage Credit Card Debt

- NerdWallet’s credit card payoff calculator — super straightforward, no creepy sign-up pressure → https://www.nerdwallet.com/article/finance/credit-card-payoff-calculator

- The CFPB debt collection guide — because collectors still call and I needed to know my rights → https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-when-a-debt-collector-contacts-me-en-1695/

- YNAB (You Need A Budget) free trial — I lasted 34 days before paying but seeing every dollar assigned made me physically ill in a helpful way → https://www.ynab.com/

The Part Where I’m Still Messy Manage Credit Card Debt

I bought concert tickets last month. On credit. I know. I’m the problem. But I immediately moved that $214 to the snowball card and added an extra $50 payment this week so at least I’m punishing myself productively now?

Point is — managing credit card debt isn’t a clean Pinterest before/after. It’s me cursing at Excel at 11 p.m., spilling LaCroix on the keyboard, texting my sister “I hate math” at 1 a.m., and then waking up and doing one tiny annoying adult thing anyway.

If you’re in it right now, just pick one stupid-small action today. One. Even if it’s literally logging into your account and looking at the number without throwing your phone. That counts.

You got any embarrassing debt stories or weird tricks that actually worked? Drop them below—I’m clearly still collecting ideas.

Love (and low balances), me